How to: Find a GREAT Lender

A lender can make or a break a deal for you, which is why they are considered part of your CORE 4 investment team (lender, agent, contractor, property manager).

I made a TON of mistakes with my first rental property, several of which had to do with financing.

LESSON #1:

Referrals - Trust but verify.

I had a friend who owned a couple properties out of state, and he introduced me to the bank he used. Even though I knew you were supposed to “bid” other lenders, I trusted that he had done that and took his recommendation without calling other banks first.

I started the preapproval process and went under contract before my preapproval was even complete. My inspection/close were so quick that I didn’t feel like I had time to shop other banks. I was freaking out enough without having to find a new lender.

It was a bad experience for several reasons- I got stuck with a residential loan officer who was not familiar with investment properties. She underwrote the deal incorrectly and I ended up calling the President of the bank in order to get my loan pushed through. They got it done, but it was a very expensive loan and came with weeks of panic.

Don’t be like me.

LESSON #2:

Do NOT underestimate loan costs when underwriting deals.

These were the actual costs of my loan:

Purchase Price = $98,600

Loan Amount = $78,880

Interest Rate = 4.25%*

Points: 2.07% = $1,632.82

Processing Fees = $500

Underwriting Fees = $995

Appraisal = $650

Title Fees = $1,161

Total Loan Costs = $4,972.82

+ Prepaid Taxes + Insurance = $1,681

Total Loan Fees + Prepaid Escrow = $6,653.82

This is $6,653.82 of CASH you need ON TOP of a down payment. I had anticipated 2-3% in closing costs, so this was a shocker when I saw the final closing disclosure.

*This was at the time interest rates fell beneath 3% for the first time in 50 years. This was a pretty high rate in comparison, but could’ve been due to the fact that I was a first time investor (with the added risk of investing out of state).

LESSON #3:

Seriously, call at least 3 (preferably more) banks before you choose a lender.

Banks have different loan products, different fee structures, and varying levels of flexibility. After calling a few, you’ll start to see what’s negotiable and what’s fairly standard. One of the most important points of flexibility (a solid pun) have to do with up-front points paid on a loan. Some banks will charge you up front points for a lower interest rate (1 point = 1% of you loan), and some offer no points in exchange for a higher rate. No points = less cash needed up front.

Another important distinction is whether the bank keeps their loans in house (portfolio loan) or whether they sell to Fannie Mae/Freddie Mac. Fannie/Freddie loans have to stick to strict guidelines, and will have fairly standard underwriting across the board. Portfolio loans have the greatest amount of flexibility (higher LTVs, lower seasoning periods, etc.) but often have higher rates. The more complex deals get, the more valuable it is to have a bank who will work with you on creative solutions.

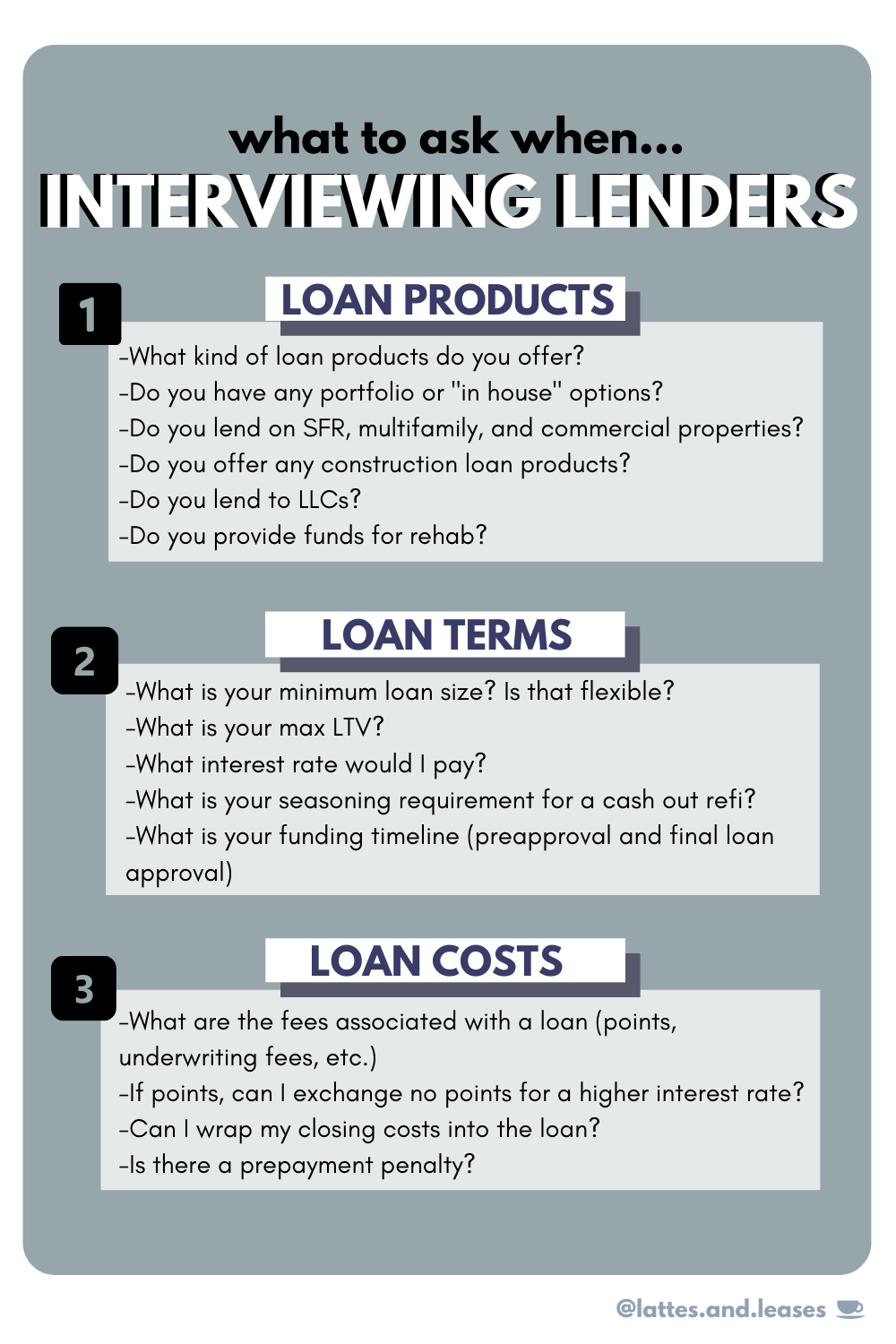

Up top are some great questions to ask banks. Try to call at least 2 big banks, 2 local banks, and 2 credit unions. You’ll not only begin to see the differences between the organizations but also will begin to feel more comfortable talking the language of lenders - an equally important skill to acquire.

Happy Hunting!